Featured

Fiduciary Tools

Investments

Plan Fees

Retirement Readiness

Participant Managed Account Fees are Expensive and Add up Over Time

Last Updated: September 08, 2023

Over the past few weeks, we have covered three big concerns that you and your fellow fiduciary committee members should be made aware of if you’re thinking about incorporating 401(k) Participant Managed Accounts into your plan.

The lack of unbiased performance benchmarking is our main concern. Without a standard for comparison, it’s hard to hold managed accounts responsible for their value to participants. Our second concern is that Participant Managed Accounts aren’t as personalized as they might seem. For a refresher on these two concerns, read our past blogs Managed Accounts Lack of Performance Benchmarking is a Red Flag You Shouldn’t Overlook and Mind the Red Flags: Unraveling the Customization Claims of 401(k) Participant Managed Accounts.

The third issue we’re highlighting—and the primary focus of this blog—revolves around high fees. For a fiduciary committee responsible for assessing a plan’s costs and prioritizing participants’ best interests, every fee carries weight. With managed accounts, the extra charges can be a substantial detriment to participants’ retirement readiness.

Top 3 Red Flags We See with 401(k) Participant Managed Accounts

You can learn more about all three concerns we have by checking out PCI’s new fiduciary resource ‘Top 3 Red Flags We See With 401(k) Participant Managed Accounts”

401(k) Participant Managed Account Fees are Expensive and Add up Over Time

By now, you’ve likely grasped the basics of these accounts. For an annual fee, participants share financial data points, which an adviser then inputs into a software program to create a portfolio lineup for them. After all, what’s the harm in adding just one more expense, especially if it is seemingly bundled with other service offerings?

As with most things that sound too good to be true, there’s a downside here that’s important to fully grasp.

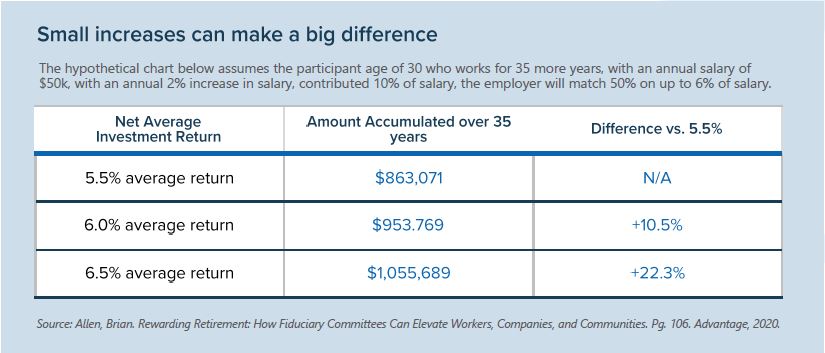

Usually, 401(k) Participant Managed Accounts come with an annual fee ranging from 0.25% to 0.75% of the account’s total balance. This doesn’t sound too bad at a cursory glance. However, these fees are stacked on top of the costs linked to the individual funds within the account. This means that combined fees for managed accounts can reach levels as high as 1.25% to 1.50% of the account’s balance per year. While this benefits the seller significantly, it sets up a substantial obstacle for the investor.

As participants’ accounts grow larger over time, they experience increasing annual losses due to managed account fees. These services have managed to remain relatively unnoticed for a while, but employees are now becoming more aware of their potential negative impact.

Consider the case of Reichert v. Juniper Networks Inc., filed in August 2021. This case claimed that numerous managed account services imitate target date fund allocations while adding extra fees. It targeted the fiduciary committee, alleging breaches of duties owed to the Plan, plaintiff, and other participants (6,860 in 2019, as per the lawsuit).

The losses incurred aren’t just restricted to the agreed-upon fees; they also affect the potential gains that could have accumulated through compounding over time. Instead, these fees end up compounding on behalf of the advisers and recordkeepers who persuaded participants to enroll in these accounts in the first place.

We anticipate more lawsuits in the future due to alleged excessive fees and the inability to justify them with benchmarked performance standards.

This case was ultimately settled for $3 million in cash. This sum, as outlined in the settlement agreement, represents over 11% of the estimated total damages of $26 million for the plan participants. This number is on par with other settlements in comparable ERISA legal cases.

Although these services may prove advantageous to a select handful of participants, it’s crucial to consider the consequences of offering them at all in the first place. To learn more about the fees and conflicts of interest surrounding 401(k) Participant Managed Accounts, simply follow the this link to watch the informative video.

We’ve found that few participants are aware that enrolling in managed account services could potentially result in annual expenses amounting to hundreds—or even thousands—of dollars annually.

We think that these services will, at most, be helpful to a small number of participants. However, in a less favorable scenario, they are likely to become a drain on funds, burdening your participants with substantial costs that can negatively impact your people’s ability to stay on track for retirement.

High fees and conflicts of interest aren’t the only issues we have with 401(k) Participant Managed Accounts – learn about our Top 3 Red Flags here.

Download the full report here.

$3 Million Settlement Struck in Managed Accounts Suit. (2022, November 15). National Association of Plan Advisors. https://www.napa-net.org/news-info/daily-news/3-million-settlement-struck-managed-accounts-suit

Pension Consultants, Inc. is registered with the U.S. Securities and Exchange Commission as an investment adviser, located at 300 S. Campbell Ave., Springfield MO, 65806. For questions or more information contact us at 417.889.4918.