Fiduciary Quick Guide

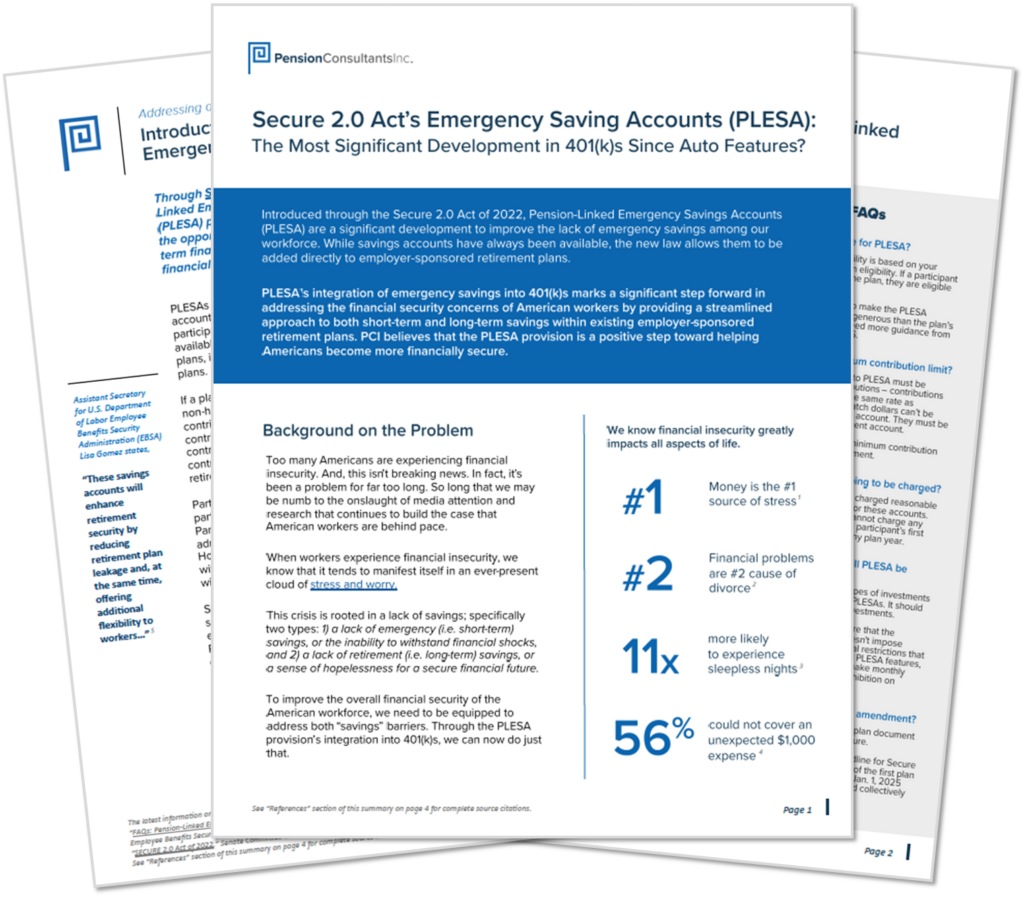

Secure 2.0 Act’s Emergency Saving Accounts (PLESA):

The Most Significant Development in 401(k)s Since Auto Features?

- Introduced through the Secure 2.0 Act of 2022, Pension-Linked Emergency Savings Accounts (PLESA) are a significant development to improve the lack of emergency savings among our workforce. While savings accounts have always been available, the new law allows them to be added directly to employer-sponsored retirement plans.

- PLESA’s integration of emergency savings into 401(k)s marks a significant step forward in addressing the financial security concerns of American workers by providing a streamlined approach to both short-term and long-term savings within existing employer-sponsored retirement plans. PCI believes that the PLESA provision is a positive step toward helping Americans become more financially secure.

On Demand Webinar

Secure 2.0 Act’s Emergency Saving Accounts (PLESA): The Most Significant Development in 401(k)s Since Auto Features?

Looking to enhance your understanding of Secure 2.0’s PLESA provision? Complete the form to tune in to the latest PCI on-demand 20-minute webinar, “Secure 2.0 Act’s Emergency Saving Accounts (PLESA): The Most Significant Development in 401(k)s Since Auto Features?”

Hosted by Brian Allen, CFP®, PCI’s Founder, Chairman, and CEO, this webinar explores implementing SECURE 2.0’s PLESA provision and provides valuable insights on the benefits of integrating emergency savings directly into 401(k) plans.

Dive Deeper

401(k)s Good For One and Good For All

Being selected to serve on your company’s retirement fiduciary committee can inspire plenty of emotions. On one hand, it’s an honor to know that your colleagues trust you enough to make important decisions about their financial future. On the other hand, it can also be a bit nerve-wracking.

If you find yourself struggling with lingering doubts about whether you’re in over your head, then rest assured. You’re not alone. Rewarding Retirement has helped countless people in the same situation.