Archives

Fourth Quarter 2014 Capital Markets Update

Last Updated: January 30, 2015

Both equity and fixed income markets got off to a rocky start in 2014 as investors grew more concerned about slower growth and higher interest rates in the year ahead. The Federal Reserve kept interest rates low through 2013 as they continued their purchase of U.S. treasuries and mortgage backed securities (Quantitative Easing or QE). Low interest rates are good for equities for two reasons:

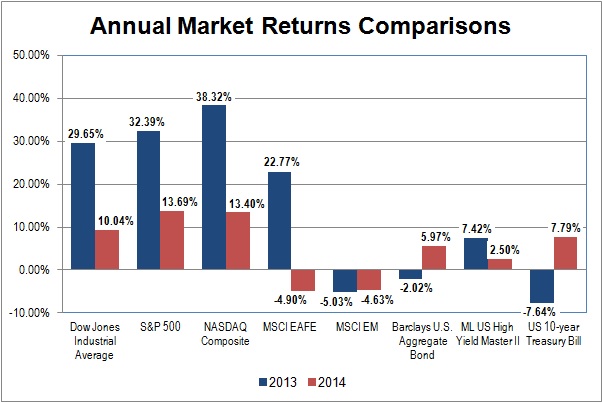

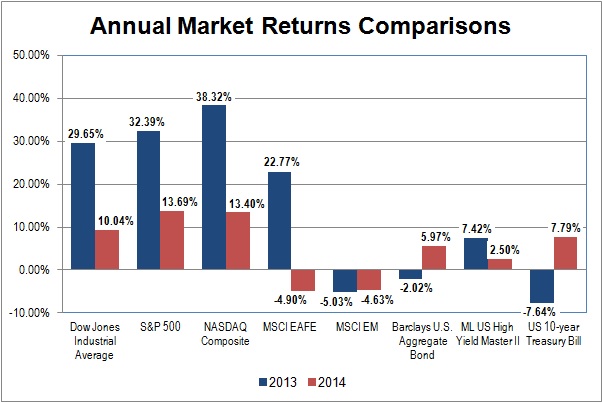

For the year ending December 31, 2014, the Dow Jones Industrial Average finished up 10.04% compared to an increase of 29.65% for 2013. The broader S&P 500 Index gained 13.69% for 2014, compared to 32.39% for 2013. Stocks of higher growth companies as measured by the NASDAQ Composite Index increased 13.40% in 2014 compared to an increase of 38.32% in 2013. International stocks of companies in developed countries as measured by the MSCI EAFE (Europe, Australasia, Far-East) Index posted a negative 4.90% return for 2014, compared to an increase of 22.77% for 2013. Emerging market equities remained under pressure from last year with the MSCI EM Index ending with a negative 4.63% return for 2014 compared to a negative 5.03% for 2013.

Fixed income markets were volatile in 2014 as growing concerns of higher interest rates and increased geopolitical tensions caused investors to move to higher-quality, lower-maturity fixed income. The broad-based Barclays U.S. Aggregate Bond Index returned 5.97% for 2014 compared to a negative 2.60% in 2013. Riskier bonds, as measured by the ML US High Yield Master II Index returned 2.50% for 2014 compared to 7.42 % for 2013. The more conservative US 10-year Treasury Bill Index posted a return 7.79% for 2014 compared to negative 7.64% for 2013, as bond investors had a flight to safety due to increased geopolitical uncertainty.

We believe that companies will face increased headwinds for sales and profitability this year given lowered expectations for global GDP growth, higher interest rates (borrowing costs), and geopolitical tensions that make it tough for U.S. companies to grow internationally. We are seeing evidence of this now as companies report their 2014 results and outlook for 2015. A number of companies have reported lower than expected earnings and outlooks, causing many investors to lock-in recent price gains and sell out of equities.

The Investment Services team at Pension Consultants focuses on investments that have proven track records through various market cycles, disciplined investment processes, and fund management that has the shareholders’ best interest in mind. This means not taking on unsuitable risks with the intention of maximizing return. A key component of successful investing is minimizing risk and losses during down markets. Our research digs deeper into understanding how a fund has outperformed in the past and how it is positioned to do so in the future. We believe in finding seasoned, proven fund management teams that have positive, consistent, long-term performance instead of individual investments that focus on maximizing return, regardless of risk.

It is also critical to have the appropriate mix of stock, bond, and cash investments based on time to retirement, risk tolerance, and return expectations. Conduct regular reviews of portfolios to make sure that allocations have not gotten out of balance as a result of recent market movements. By diversifying across asset classes, you have exposure to investments that provide growth, income, and preservation of capital (liquidity) through various economic cycles and minimize your risk.

Our Investment Services can help identify investment funds that are in line with your retirement plan goals, while mitigating the risk. To learn more, please contact a Pension Consultants Investment Consultant at 800-234-9584 or email us at investmentservices@pension-consultants.com.

For the year ending December 31, 2014, the Dow Jones Industrial Average finished up 10.04% compared to an increase of 29.65% for 2013. The broader S&P 500 Index gained 13.69% for 2014, compared to 32.39% for 2013. Stocks of higher growth companies as measured by the NASDAQ Composite Index increased 13.40% in 2014 compared to an increase of 38.32% in 2013. International stocks of companies in developed countries as measured by the MSCI EAFE (Europe, Australasia, Far-East) Index posted a negative 4.90% return for 2014, compared to an increase of 22.77% for 2013. Emerging market equities remained under pressure from last year with the MSCI EM Index ending with a negative 4.63% return for 2014 compared to a negative 5.03% for 2013.

Fixed income markets were volatile in 2014 as growing concerns of higher interest rates and increased geopolitical tensions caused investors to move to higher-quality, lower-maturity fixed income. The broad-based Barclays U.S. Aggregate Bond Index returned 5.97% for 2014 compared to a negative 2.60% in 2013. Riskier bonds, as measured by the ML US High Yield Master II Index returned 2.50% for 2014 compared to 7.42 % for 2013. The more conservative US 10-year Treasury Bill Index posted a return 7.79% for 2014 compared to negative 7.64% for 2013, as bond investors had a flight to safety due to increased geopolitical uncertainty.

We believe that companies will face increased headwinds for sales and profitability this year given lowered expectations for global GDP growth, higher interest rates (borrowing costs), and geopolitical tensions that make it tough for U.S. companies to grow internationally. We are seeing evidence of this now as companies report their 2014 results and outlook for 2015. A number of companies have reported lower than expected earnings and outlooks, causing many investors to lock-in recent price gains and sell out of equities.

The Investment Services team at Pension Consultants focuses on investments that have proven track records through various market cycles, disciplined investment processes, and fund management that has the shareholders’ best interest in mind. This means not taking on unsuitable risks with the intention of maximizing return. A key component of successful investing is minimizing risk and losses during down markets. Our research digs deeper into understanding how a fund has outperformed in the past and how it is positioned to do so in the future. We believe in finding seasoned, proven fund management teams that have positive, consistent, long-term performance instead of individual investments that focus on maximizing return, regardless of risk.

It is also critical to have the appropriate mix of stock, bond, and cash investments based on time to retirement, risk tolerance, and return expectations. Conduct regular reviews of portfolios to make sure that allocations have not gotten out of balance as a result of recent market movements. By diversifying across asset classes, you have exposure to investments that provide growth, income, and preservation of capital (liquidity) through various economic cycles and minimize your risk.

Our Investment Services can help identify investment funds that are in line with your retirement plan goals, while mitigating the risk. To learn more, please contact a Pension Consultants Investment Consultant at 800-234-9584 or email us at investmentservices@pension-consultants.com.

- Companies can borrow money cheaply to expand their businesses, increase sales and profits, and/or buy back shares of their stock – all of which typically lead to higher stock prices and,

- When interest rates are low, bonds are relatively unattractive compared to equities because bondholders receive less interest income. As a result, many investors rotated out of bonds and increased their equity exposure.

For the year ending December 31, 2014, the Dow Jones Industrial Average finished up 10.04% compared to an increase of 29.65% for 2013. The broader S&P 500 Index gained 13.69% for 2014, compared to 32.39% for 2013. Stocks of higher growth companies as measured by the NASDAQ Composite Index increased 13.40% in 2014 compared to an increase of 38.32% in 2013. International stocks of companies in developed countries as measured by the MSCI EAFE (Europe, Australasia, Far-East) Index posted a negative 4.90% return for 2014, compared to an increase of 22.77% for 2013. Emerging market equities remained under pressure from last year with the MSCI EM Index ending with a negative 4.63% return for 2014 compared to a negative 5.03% for 2013.

Fixed income markets were volatile in 2014 as growing concerns of higher interest rates and increased geopolitical tensions caused investors to move to higher-quality, lower-maturity fixed income. The broad-based Barclays U.S. Aggregate Bond Index returned 5.97% for 2014 compared to a negative 2.60% in 2013. Riskier bonds, as measured by the ML US High Yield Master II Index returned 2.50% for 2014 compared to 7.42 % for 2013. The more conservative US 10-year Treasury Bill Index posted a return 7.79% for 2014 compared to negative 7.64% for 2013, as bond investors had a flight to safety due to increased geopolitical uncertainty.

We believe that companies will face increased headwinds for sales and profitability this year given lowered expectations for global GDP growth, higher interest rates (borrowing costs), and geopolitical tensions that make it tough for U.S. companies to grow internationally. We are seeing evidence of this now as companies report their 2014 results and outlook for 2015. A number of companies have reported lower than expected earnings and outlooks, causing many investors to lock-in recent price gains and sell out of equities.

The Investment Services team at Pension Consultants focuses on investments that have proven track records through various market cycles, disciplined investment processes, and fund management that has the shareholders’ best interest in mind. This means not taking on unsuitable risks with the intention of maximizing return. A key component of successful investing is minimizing risk and losses during down markets. Our research digs deeper into understanding how a fund has outperformed in the past and how it is positioned to do so in the future. We believe in finding seasoned, proven fund management teams that have positive, consistent, long-term performance instead of individual investments that focus on maximizing return, regardless of risk.

It is also critical to have the appropriate mix of stock, bond, and cash investments based on time to retirement, risk tolerance, and return expectations. Conduct regular reviews of portfolios to make sure that allocations have not gotten out of balance as a result of recent market movements. By diversifying across asset classes, you have exposure to investments that provide growth, income, and preservation of capital (liquidity) through various economic cycles and minimize your risk.

Our Investment Services can help identify investment funds that are in line with your retirement plan goals, while mitigating the risk. To learn more, please contact a Pension Consultants Investment Consultant at 800-234-9584 or email us at investmentservices@pension-consultants.com.

For the year ending December 31, 2014, the Dow Jones Industrial Average finished up 10.04% compared to an increase of 29.65% for 2013. The broader S&P 500 Index gained 13.69% for 2014, compared to 32.39% for 2013. Stocks of higher growth companies as measured by the NASDAQ Composite Index increased 13.40% in 2014 compared to an increase of 38.32% in 2013. International stocks of companies in developed countries as measured by the MSCI EAFE (Europe, Australasia, Far-East) Index posted a negative 4.90% return for 2014, compared to an increase of 22.77% for 2013. Emerging market equities remained under pressure from last year with the MSCI EM Index ending with a negative 4.63% return for 2014 compared to a negative 5.03% for 2013.

Fixed income markets were volatile in 2014 as growing concerns of higher interest rates and increased geopolitical tensions caused investors to move to higher-quality, lower-maturity fixed income. The broad-based Barclays U.S. Aggregate Bond Index returned 5.97% for 2014 compared to a negative 2.60% in 2013. Riskier bonds, as measured by the ML US High Yield Master II Index returned 2.50% for 2014 compared to 7.42 % for 2013. The more conservative US 10-year Treasury Bill Index posted a return 7.79% for 2014 compared to negative 7.64% for 2013, as bond investors had a flight to safety due to increased geopolitical uncertainty.

We believe that companies will face increased headwinds for sales and profitability this year given lowered expectations for global GDP growth, higher interest rates (borrowing costs), and geopolitical tensions that make it tough for U.S. companies to grow internationally. We are seeing evidence of this now as companies report their 2014 results and outlook for 2015. A number of companies have reported lower than expected earnings and outlooks, causing many investors to lock-in recent price gains and sell out of equities.

The Investment Services team at Pension Consultants focuses on investments that have proven track records through various market cycles, disciplined investment processes, and fund management that has the shareholders’ best interest in mind. This means not taking on unsuitable risks with the intention of maximizing return. A key component of successful investing is minimizing risk and losses during down markets. Our research digs deeper into understanding how a fund has outperformed in the past and how it is positioned to do so in the future. We believe in finding seasoned, proven fund management teams that have positive, consistent, long-term performance instead of individual investments that focus on maximizing return, regardless of risk.

It is also critical to have the appropriate mix of stock, bond, and cash investments based on time to retirement, risk tolerance, and return expectations. Conduct regular reviews of portfolios to make sure that allocations have not gotten out of balance as a result of recent market movements. By diversifying across asset classes, you have exposure to investments that provide growth, income, and preservation of capital (liquidity) through various economic cycles and minimize your risk.

Our Investment Services can help identify investment funds that are in line with your retirement plan goals, while mitigating the risk. To learn more, please contact a Pension Consultants Investment Consultant at 800-234-9584 or email us at investmentservices@pension-consultants.com.